Commentary: Hoteliers say no on 18-120

/Commentary by, Klamath County Hoteliers (KlamathTourism.com)

Ballots are due by Tuesday the 18th for this May election. You might not think a May election ballot is worth your time to turn in, but Klamath County Hoteliers have grouped together to ask you to VOTE NO.

The only measure on the ballot is for an increase of 3% to the Klamath County Transient Room Tax collection. The description on the ballot lists that, with the passage, the county tourism tax would increase from the current 8% to 11%. However, there is a lot that the County is not telling you.

What Klamath County Commissioners are not telling you about the proposed tax increase

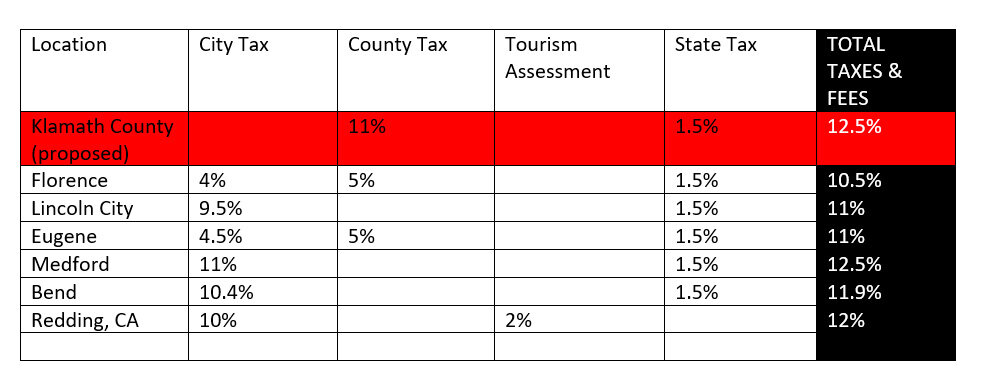

They failed to mention the total tax that will then be charged to any guest of a hotel, motel, RV stay, or vacation rental in the county. The current total is 9.5% (8% Klamath County and 1.5% State Tourism Tax). This means that an increase of 3% will result in a total of 12.5% being charged.

This will put Klamath County hoteliers at a huge disadvantage. Being at 12.5% would result in Klamath County in having one of the highest tax percentages for hotel/motel tax in the State.

Below is a breakdown of the taxes and how Klamath County will compare if this measure is passed.

A passage of this measure will result in Klamath County guest paying a 12.5% hotel/motel tax. Local hoteliers plead with voters to not approve this drastic increase.

Local owner of the Big Pine RV Park in Cresent is worried about how the tax will affect his business. Bruce the owner said “This increase to our lodging tax will put Klamath County out of step with the surrounding counties. With a total 12.5% tax, I will be at a competitive disadvantage, competing with properties that offer the same amenities that I do”.

This is not the first time that local parties have tried to tap the well of the hotel/motel tax

Over the past three years Discover Klamath Executive Director, Jim Chadderdon, has been pushing for a Tourism Improvement Area (TIA) to be set up so that Discover Klamath (the local tourism marketing agency) could receive more funding. In the past year members of the community interested in hijacking tourism dollars for their own interests, used the concept of a TIA to try and get a 3% Tourism Assessment Fee added to the already collected 9.5%.

“The idea behind any type of business improvement district is to allow the business that will be assessed the fee a chance to group together for a common goal, and self- assesses themselves a fee.” States Victoria Haley, a local Tourism Consultant. “That is not what was done this past year. Jim Chadderdon, Discover Klamath, and the County Commissioners passed through an ordinance allowing Tourism Improvement Areas to be created against the very vocal opposition of the local hoteliers.”

After the County approved the ordinance, a group led by Chadderdon submitted a TIA proposal for a 3% Tourism Assessment fee to be put in place. Luckily, the hotel owners were able to get more than the 34% of signatures (by TRT currently paid) to get the TIA proposal shut down.

“This ballot measure is just another way that the County and a small group of people to shove this 3% increase, they want, down the throats of hoteliers and hotel guests,” said Haley. “Not to mention, that the $700 thousand plus dollars that would be collected by this 3%, is going to be at the sole discretion of the County Commissioners to spend, leaving hoteliers with no voice.”

This is not the first time an increase in the Tourism Tax has been unwelcomed by hoteliers. In 2006, a similar ballot measure was passed adding 2% to the then 6% Klamath County Tourism Tax rate. Local hoteliers were not in favor of the 2006 increase and felt that they had no option to voice their opinions.

Many people also feel that the current 8% that is being collected by the County is not being spent as intended.

“The money is supposed to be spent to generate additional tourism for the area, and generate heads-in-beds.” Haley said “This is not what is happening with most of the dollars collected. It is being spent with little to no return on investment.”

Haley, and the local hoteliers, have worked tirelessly for the past three years to work with the County and Discover Klamath, paving a path for collecting funds that would go to benefit the growth of tourism in the County. Haley has suggested putting in place a Tourism Improvement Area that is run and managed by the hoteliers. These funds would be used to provide tourism business incentives for new restaurants or breweries, tourism infrastructure, and tourism promotion with strict return on investment indicators.

“No one has more skin in the game to make sure funds are spent generating additional room volume than hoteliers. This ballot measure is a poorly written and not transparent way for the Klamath County Commissioners to convince the local voters to dump hundreds of thousands of dollars in the Commissioner’s lap to spend money on the same things they are already wasting the Tourism Tax Dollars on. Everyone should turn in their ballots and everyone should vote NO on measure 18-120.”

For more information on reasons to Vote NO on the May 18th ballot measure to increase Transient Room Tax please visit KlamathTourism.com.

Commentaries, are professionally written pieces which present an argument and use research to support the stated opinion. Writers are sharing their own personal opinion and not the staff of Klamath Falls News. To submit an editorial click here.

The viewpoints expressed by the authors do not necessarily reflect the opinions, viewpoints, and official policies of Klamath Falls News.